Over the past 4 months, the Trump Administration and Congress have made their economic policy clear – stimulate the economy to spur more growth at a time of full or near full unemployment. The theory Trump officials and Congressional Republicans promote is that tax cuts will spur such dramatic economic growth that the deficit impact will be zero. The CBO does not agree, and as a non-partisan agency, has projected $1.5 trillion in additional deficit, from the tax cuts, over 10 years.

The Tax Cuts and Jobs Act (TCJA) largely benefits corporations (35% to 21% corporate rate) , pass-through businesses and wealthy individuals. Here is how the Tax Policy Center of the Urban Institute and Brookings Institute break out the benefits:

In 2018, taxes would be reduced by about $1,600 on average, increasing after-tax incomes 2.2 percent (table 1). Taxes would decline on average across all income groups. Taxpayers in the bottom quintile (those with income less than $25,000) would see an average tax cut of $60, or 0.4 percent of after-tax income. Taxpayers in the middle income quintile (those with income between about $49,000 and $86,000) would receive an average tax cut of about $900, or 1.6 percent of after-tax income. Taxpayers in the 95th to 99th income percentiles (those with income between about $308,000 and $733,000) would benefit the most as a share of after-tax income, with an average tax cut of about $13,500 or 4.1 percent of after-tax income. Taxpayers in the top 1 percent of the income distribution (those with income more than $733,000) would receive an average cut of $51,000, or 3.4 percent of after-tax income.”

Their research indicates that taxpayers in the 95th-100th income percentiles ($300K+ and up) will benefit the most at 4.1%, followed by those in the top 1% who will get 3.4%. So even on a percentage basis (not absolute dollars), those at the very top are the greates individual benefactors of this reduction.

Another benefit for the very wealthy comes on the estate side. As Forbes (a conservative publication favoring tax reduction) reports:

The tax bill, passed by the House and Senate yesterday, temporarily doubles the exemption amount for estate, gift and generation-skipping taxes from the $5 million base, set in 2011, to a new $10 million base, good for tax years 2018 through 2025. The exemption is indexed for inflation, so it looks like an individual can shelter $11.2 million in assets from these taxes. Another federal estate law provision called portability lets couples who do proper planning double that exemption. So, a couple could exclude $22.4 million for 2018.

In an upcoming set of interviews with my neighbors in Berrien County (to be soon published on this site), supporters of these cuts shrug off these facts (“Let the Rich be Rich” one said) and project that the benefits to middle class Americans will come through increased incremental business investment. One said that investment-spurred growth due to the tax reductions will cover and erase the projected $1.5 trillion deficit.

So let’s assess the growth that will be spurred by the tax cut:

- Corporations, especially large ones, are sitting on $1.84 trillion in cash in the US as of 07/19/2017, according to Moody’s. They have had the dollars to invest for years but have not. Instead they have bought back stock or hoarded the cash. There may be an incremental incentive to invest if effective rates are now lower due to the new law, but the Companies themselves have said they are likely to reward shareholders first before investing.

- An argument could be made that if US tax rates have been higher than foreign rates, then changing the playing field so US companies pay the same rates as firms abroad should bring business back to the US from offshore. But effective business tax rates in the US have not been much higher than OECD tax rates, even before the corporate rate reduction. As an article in Forbes (“The Truth About Corporate Tax Rates”) by Martin Sullivan, 3/25/15, concludes:

The bottom line: The conclusion reached by the CRS report is more accurate than that of the Business Roundtable. On average, the foreign effective tax rate is not much lower than the U.S. domestic tax rate.

(Note that Forbes generally supports tax reductions.)

It is a gamble to say that US investment versus offshore investment will increase due to these tax reductions.

- Partnerships, generally smaller than public corporations, will benefit from pass-through provisions of the bill. While surveys show some of these firms will increase investment, the question is how many and how much:

- A survey by Bank of America and Merrill Lynch indicates that just 35% of firms will spend their reductions on capital expenditures.

- The Federal Reserve Bank of Atlanta did a survey indicating that 59% of firms say they will not increase their planned hiring, while 39% said they would. 46% said they would not change their capital investment plans, while 51% said they would.

So some increase in hiring and investment is likely, but not enough to offset the likely increase in deficit spending.

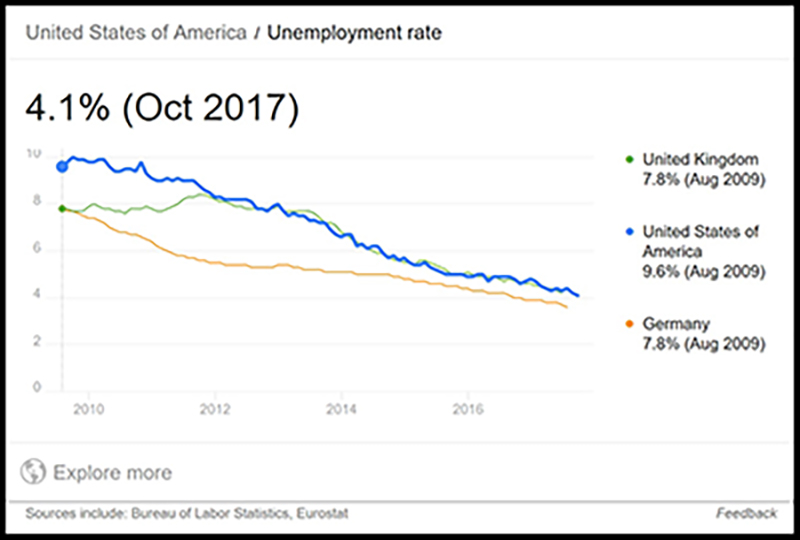

- In a full employment economy, with overheating, there is a risk that inflationary pressures or asset inflation (“bubbles”) will grow and that the Federal Reserve will raise interest rates to choke it off. Over the past two decades, the supply of goods in the world economy has had a moderating effect on inflation. But as worker supply in the US gets tighter, and if wages increase as a result, it is uncertain as to whether businesses will absorb lower margins or raise prices to consumers.If the former, workers could benefit for the first time in several decades if wages increase.

If the latter, the economy could head for a recession, as inflation spikes and the Federal Reserve reacts. This is a risk to growth.

The Trump administration has taken other steps, some of which support and some of which could hurt the economy:

- Regulations have been loosened, but these primarily impact extractive industries such as coal, oil and gas. These industries already were booming based on market pricing. Market price is the biggest determinate of investment in these industries. not these regulations.

- Immigration restrictions have already caused agricultural labor shortages in California, Michigan and other places. This is a drag on the economy.

- The infrastructure initiative just announced could add to overall economic demand but it’s structure relies heavily on States, who are already overburdened. This program overpromises and is likely to under-deliver, but could be another source of overheating the economy, this time through spending.

- This past week, on 3/1, the President announced tariffs to be imposed on aluminum and steel. Besides alienating allies and damaging the reputation of the US vis a vis the trading order it has established, experts believe substantial damage can occur to the US economy if a trade war breaks out.

- Productivity growth cannot be predicted to rise due to these tax reductions. There are no direct incentives to investment in the Trump tax cuts. In recent years, productivity has been unpredictable.

Summary:

- The tax reductions inordinately benefit the top 5% and 1% of tax payers.

- It is optimistic to believe that deficits incurred by the Trump tax bill will pay for themselves when we look closely at sources of growth and risks in an economy already at full employment. As explained above, there are positive factors (better business confidence, lower business taxes for pass-through structures) and negative factors (immigration restrictions, a looming trade war, full employment with wage increases possible) that counter balance each other, making it unlikely that growth will accelerate dramatically over the next few years for a full 10 year run. The risk of at least one recession in those 10 years is substantial.

- It has to be kept in mind that any increase in deficits (the $1.5 trillion projected or something less) will be paid for by the general US public. This increase in US debt is not free, especially as rates rise. When it needs to be paid off, it is likely that the middle class will bear the brunt, either from reduced services or benefits, or through tax increases, or both. It is notable that Paul Ryan has already begun to talk about cutting middle class entitlements (such as Social Security and Medicare).

- The middle class and the US as a whole will be a long-term loser due to the long-run negative impacts of this bill on the fiscal health of the US.

True Republicans and fiscal conservatives (this author among them) need to oppose the damage being done to our fiscal health by this bill, and push for its repeal.